Aim for the Gold Standard in Measuring Point-of-Care Marketing

If you’ve been asking hard questions about the data provided by your DTC and POC campaign partners, you’re not alone. Although the heightened scrutiny is new, the challenges aren’t. The good news is that trustworthy solutions are established, proven, and available.

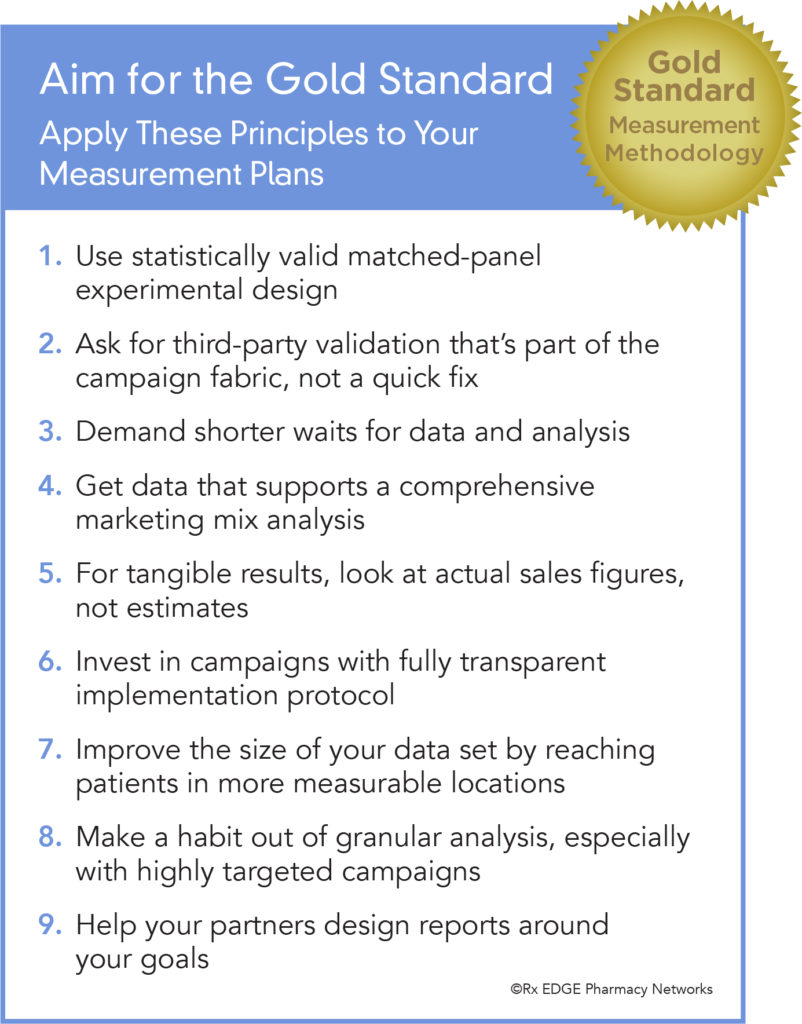

Treatment decisions and research are guided by data that meets exacting standards for quality, reliability, and accuracy. The campaigns you use to reach patients should be no different. Take charge and build confidence in your marketing results by aiming for the gold standard in verifiable, trustworthy performance metrics and applying these standards to your brand messaging.

Use statistically valid matched-panel experimental design. Long before any of us learn the intricacies of marketing disciplines, we learn the fundamentals of any sound experiment: the test and control groups. Yet those principles are often overlooked when budgeting significant sums of money to reach patients with information that can significantly improve their quality of life. Get back to basics by working with partners that can demonstrate that the demographics and media exposure in both test and control groups are the same. Your partner should also isolate for seasonal and market factors, and measure results in weeks both pre- and post-campaign.

Use statistically valid matched-panel experimental design. Long before any of us learn the intricacies of marketing disciplines, we learn the fundamentals of any sound experiment: the test and control groups. Yet those principles are often overlooked when budgeting significant sums of money to reach patients with information that can significantly improve their quality of life. Get back to basics by working with partners that can demonstrate that the demographics and media exposure in both test and control groups are the same. Your partner should also isolate for seasonal and market factors, and measure results in weeks both pre- and post-campaign.

Ask for third-party validation that’s part of the campaign fabric, not a quick fix. The widespread industry focus on third-party validation is as welcome as it is overdue. But it should be part of your partner’s business model, not an afterthought, bandage, or public relations move. The independent third-party analyst should be working with timely sales data and presenting reports to clients in a timely manner. That means weeks, not months. And if the independent analyst hasn’t been working with your partner for years, it bears asking why.

Ask for third-party validation that’s part of the campaign fabric, not a quick fix. The widespread industry focus on third-party validation is as welcome as it is overdue. But it should be part of your partner’s business model, not an afterthought, bandage, or public relations move. The independent third-party analyst should be working with timely sales data and presenting reports to clients in a timely manner. That means weeks, not months. And if the independent analyst hasn’t been working with your partner for years, it bears asking why.

Demand shorter waits for data and analysis. Understanding the health and success of your campaigns needs more than just raw data. It needs data in a timely manner, soon enough to be able to make sensible adjustments before seasonal effects and other market forces can overwhelm your ability to act. Yet delays of 45 to 60 days just to get a data snapshot are common among many campaign partners and data providers. The right partners have relationships with POC operators and data aggregators to make delivery a priority.

Demand shorter waits for data and analysis. Understanding the health and success of your campaigns needs more than just raw data. It needs data in a timely manner, soon enough to be able to make sensible adjustments before seasonal effects and other market forces can overwhelm your ability to act. Yet delays of 45 to 60 days just to get a data snapshot are common among many campaign partners and data providers. The right partners have relationships with POC operators and data aggregators to make delivery a priority.

Get data that supports your comprehensive marketing mix analysis needs. As the range of DTC and POC outreach channels grows, it’s becoming increasingly important to follow the lead of other industries and conduct detailed marketing mix analysis. Ideally, you want to understand just how much each channel’s investment contributes to the overall success of your marketing plan. That’s harder to do if your data partners can’t provide detailed analysis of the periods before and after your campaign or can’t isolate for the effects of your other media investments. Work with your trusted providers to ensure that the proper metrics from their respective campaigns are incorporated into your marketing mix analysis template.

Get data that supports your comprehensive marketing mix analysis needs. As the range of DTC and POC outreach channels grows, it’s becoming increasingly important to follow the lead of other industries and conduct detailed marketing mix analysis. Ideally, you want to understand just how much each channel’s investment contributes to the overall success of your marketing plan. That’s harder to do if your data partners can’t provide detailed analysis of the periods before and after your campaign or can’t isolate for the effects of your other media investments. Work with your trusted providers to ensure that the proper metrics from their respective campaigns are incorporated into your marketing mix analysis template.

For tangible results, look at actual sales figures, not estimates. Because of concerns ranging from patient confidentiality to a lack of interactivity, many POC and DTC channels only allow results to be measured in broad strokes. Inferences and estimates, not hard conversions and sales, are the best you can get from broadcast or with in-clinic messaging. Invest some of your campaigns in channels that can deliver actual sales figures, not just assumptions and correlations. Partners that can analyze prescription sales data, obtained in cooperation with the largest retail pharmacy chains, can capture actual incremental script volume at the location or market level. It is more straightforward to attribute ROI to actual sales volume changes than to softer measures like ad recall or reach. And when you can isolate results at the individual store level, you get a much clearer picture of campaign lift than regional or nationwide trends can reveal.

For tangible results, look at actual sales figures, not estimates. Because of concerns ranging from patient confidentiality to a lack of interactivity, many POC and DTC channels only allow results to be measured in broad strokes. Inferences and estimates, not hard conversions and sales, are the best you can get from broadcast or with in-clinic messaging. Invest some of your campaigns in channels that can deliver actual sales figures, not just assumptions and correlations. Partners that can analyze prescription sales data, obtained in cooperation with the largest retail pharmacy chains, can capture actual incremental script volume at the location or market level. It is more straightforward to attribute ROI to actual sales volume changes than to softer measures like ad recall or reach. And when you can isolate results at the individual store level, you get a much clearer picture of campaign lift than regional or nationwide trends can reveal.

Invest in POC campaigns with fully transparent implementation protocol. It’s tough to argue with the old international diplomacy adage “trust, but verify.” Partners should earn and maintain a level of trust that means you, the client, don’t feel the constant need to send secret shoppers to check every last rollout of every single campaign. But when verification is important, you want to be able to get answers as quickly and unobtrusively as possible. POC campaigns that reach into semi-private or off-limits areas, like clinic rooms, are cumbersome and difficult to verify. Campaigns in public spaces with growing importance as a hub for coordinated care, like the retail pharmacy, are much easier to verify. Ideally, your partner will provide signoff from its own field force, so you can confirm the date each new campaign launched at every location.

Invest in POC campaigns with fully transparent implementation protocol. It’s tough to argue with the old international diplomacy adage “trust, but verify.” Partners should earn and maintain a level of trust that means you, the client, don’t feel the constant need to send secret shoppers to check every last rollout of every single campaign. But when verification is important, you want to be able to get answers as quickly and unobtrusively as possible. POC campaigns that reach into semi-private or off-limits areas, like clinic rooms, are cumbersome and difficult to verify. Campaigns in public spaces with growing importance as a hub for coordinated care, like the retail pharmacy, are much easier to verify. Ideally, your partner will provide signoff from its own field force, so you can confirm the date each new campaign launched at every location.

Improve the size of your data set by reaching more patients in more measurable locations. Studies show that a typical patient visits a pharmacy to purchase self-prescribed OTC products eight times more often than they visit a physician in clinic. And outcomes in the retail pharmacy setting are much easier to measure than in a stand-alone clinic. Increase your exposure there, and you increase the size and robustness of your data.

Improve the size of your data set by reaching more patients in more measurable locations. Studies show that a typical patient visits a pharmacy to purchase self-prescribed OTC products eight times more often than they visit a physician in clinic. And outcomes in the retail pharmacy setting are much easier to measure than in a stand-alone clinic. Increase your exposure there, and you increase the size and robustness of your data.

Make a habit out of granular analysis, especially with highly targeted campaigns. Fine-tuning campaigns down to a region or market lets you reinforce your presence where performance is already strong, and elevate it where your performance is weak. You can also use these campaigns to test how entrenched a dominant competitor is. These focused experiments should be measured as carefully as a national rollout, but the results should be kept in the proper context. A high-performing test can be used to model the rollout and expectations for a broader campaign.

Make a habit out of granular analysis, especially with highly targeted campaigns. Fine-tuning campaigns down to a region or market lets you reinforce your presence where performance is already strong, and elevate it where your performance is weak. You can also use these campaigns to test how entrenched a dominant competitor is. These focused experiments should be measured as carefully as a national rollout, but the results should be kept in the proper context. A high-performing test can be used to model the rollout and expectations for a broader campaign.

Help your partners design reports around your clear, transparent goals. In the long run, partners gear the depth of their analysis to the demands of clients. Early DTC campaigns focused on recall, so data reflected that. As the demand for clearer ROI and more repeatable results grows, partners will shift to accommodate. The clearer you are about your analytics needs, the more the industry will shift to match.

Help your partners design reports around your clear, transparent goals. In the long run, partners gear the depth of their analysis to the demands of clients. Early DTC campaigns focused on recall, so data reflected that. As the demand for clearer ROI and more repeatable results grows, partners will shift to accommodate. The clearer you are about your analytics needs, the more the industry will shift to match.

This is a terrific inflection point for the POC and DTC marketing industry, an essential channel for strong patient communication. But it’s not a doom-and-gloom moment. If anything, the renewed emphasis on verifiable results, validated figures, and trustworthy insights is causing us all to be more mindful of the work we do and the impact it has. And that’s a powerful, tangible result in itself.