By Linda J. DiPersio, MSM, MSHC

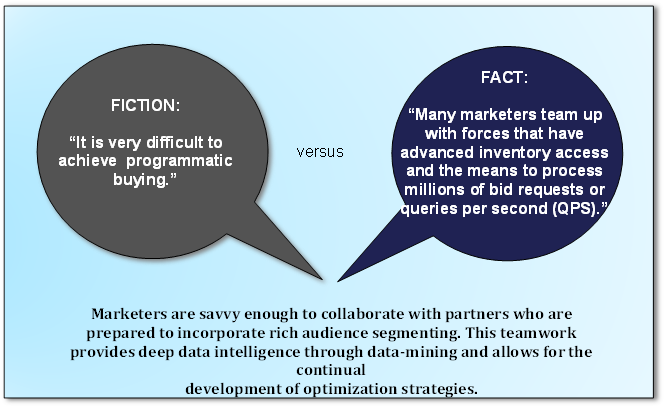

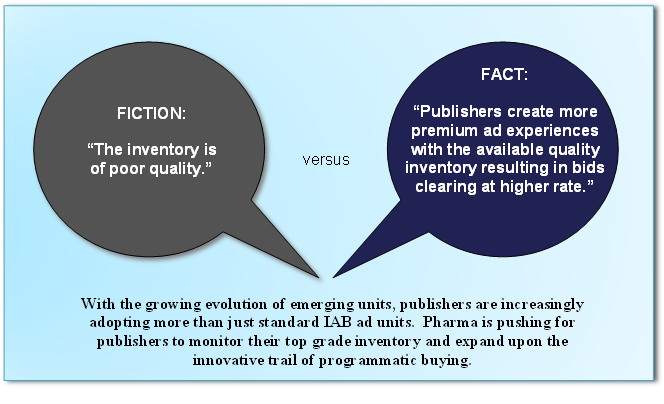

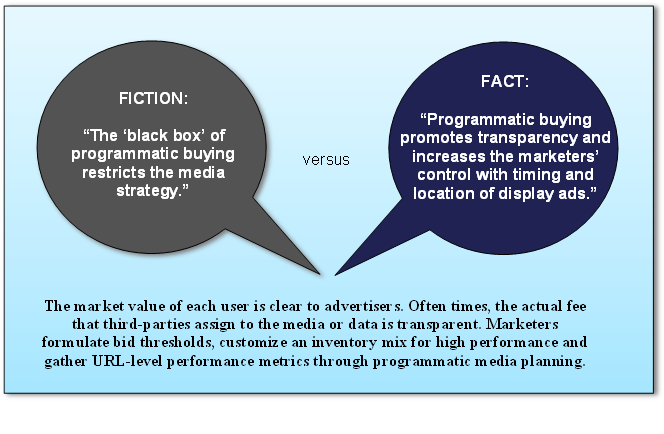

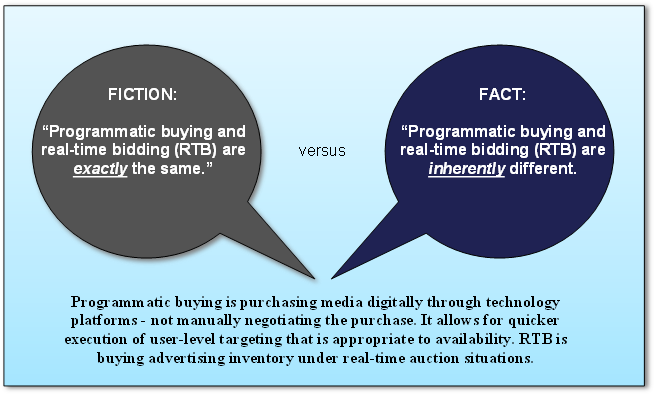

A recent eMarketer study projects that by the end of this year 63% of the overall digital display ad spending in the United States will be attributed to programmatic media buying – and this figure is estimated to soar towards 83% in 2017. In the pharmaceutical industry, programmatic buying uses software interfaces and algorithms to define and analyze specific traits of patients who have a strong inclination to purchase certain medications over others. This data allows digital ad spaces to be tailored to patients more accurately, which influences and supports a patient-centric media strategy in a positive way. The skillful use of programmatic buying within this platform not only depends on educating marketers to recognize the myths but also on encouraging them to follow the trends that will lead to an increased level of patient centricity and greater financial success and efficiency.

Fictional vs. Factual Information about Programmatic Media Buying

2016 Trends in Programmatic Buying

Engaging Purchase-Based Targeting (PBT). With (PBT), marketers analyze segments of small groups of individuals that bought the product previously and then conduct exact image modeling to increase profits by finding more patients who are willing to buy. Behavioral and contextual data attributes enhance this digital segmentation.

Planning with Direct Automation. Advertisers create audiences inside their Data Management Platforms (DMPs) with automated guaranteed procurement. They push them directly to a publisher’s ad server that participates in user-matching.

Managing Global Frequency. Marketers effectively map users to all of their devices, match users across a myriad of platforms and determine frequency to an individual. They control their messaging and influence their bidding strategies to usher users into frequency where conversions emerge.

Managing Global Frequency. Marketers effectively map users to all of their devices, match users across a myriad of platforms and determine frequency to an individual. They control their messaging and influence their bidding strategies to usher users into frequency where conversions emerge.

Bringing Talent In-House. Hiring former agencies and vendors, certifying their own technologies and retaining their own data are only a few of the ways that big marketers are consolidating talent internally. They desire an intense and direct connection to experts who specialize in programmatic buying and analysts who are focused on data science.

Closing the Loop with Data. The marketing attribution adage of “50% of my marketing works, but I just don’t know which 50%” is now showing 100% closure with organized substantiation. One example is specific beacon technology that allows marketers to actualize results with a three step process: 1) patients are alerted through social media on their mobile devices about a discount offer through social media; 2) their arrival at the pharmacy is verified and 3) data is integrated with the point-of-sale (POS) system that immediately indicates if the product was purchased.

Permitting Technology to Make Determinations. From the outset, data machine algorithms determine the exact make up and segmentation of the patient giving marketers an advanced and full understanding of the shared features of data attributes. Smoother media planning arises from automatic segment generation.

In conclusion, by understanding fact versus fiction and paying close attention to this year’s trends in programmatic buying, marketers can achieve more effective campaigns on a smaller budget and in a timely fashion. Algorithmic data analysis combined with a transparent, unbiased framework strengthens this type of buying and creates a win-win situation for the patient-centric media strategy. With programmatic buying projections, the pharmaceutical industry currently has the fortuitous chance to track the patient journey with available data delivering deeper, clearer and more concise content in the right place to the right people at the right time.

References:

Kleveno, K. “Debunking 5 Myths of Programmatic Buying.” 360i Digital Agency. (2013)

Loechner, J. “Marketers Face More Pressures Than Just Marketing.” MediaPost (2014)

O’Hara, C. “Trends in Programmatic Buying.” Media Measurement. (2015)

“Mobile Marketers Think Programmatic Advertising Is the Future So Why Aren’t They Using It?” CallFire (2015)

“A Look Inside Programmatic Pricing.” AdWeek (2015).

In the book “The Innovator’s Prescription: A Disruptive Solution for Health Care,” Clay Christensen, who developed the theory of disruptive innovation, stated, “There are more than 9,000 billing codes for individual procedures and units of care. But there is not a single billing code… for helping patients stay well.” In the pharmaceutical industry, disruptive innovation improves health by generating ideas that create new drugs at the expense of existing ones. It is an alliance between technological advances and new business models that dramatically changes the performance of the industry. The progressive spectrum of disruptive innovation challenges include lessons from the past showing resistance to change, implications surfacing in the present which emerge from cautious analytics and trailblazing dynamics in the future aligned with patient centricity.

In the book “The Innovator’s Prescription: A Disruptive Solution for Health Care,” Clay Christensen, who developed the theory of disruptive innovation, stated, “There are more than 9,000 billing codes for individual procedures and units of care. But there is not a single billing code… for helping patients stay well.” In the pharmaceutical industry, disruptive innovation improves health by generating ideas that create new drugs at the expense of existing ones. It is an alliance between technological advances and new business models that dramatically changes the performance of the industry. The progressive spectrum of disruptive innovation challenges include lessons from the past showing resistance to change, implications surfacing in the present which emerge from cautious analytics and trailblazing dynamics in the future aligned with patient centricity. As the above example shows, the advancement of pharmaceutical innovation efforts are most often prevented by established world views, opinions, customs, attitudes, societal values and complex psychological and emotional issues ingrained in the network of relationships that define individuals singly or collectively. In certain situations, innovation challenges are rejected directly because they are seen as threats to the means of support and character of many stakeholders, such as pharmaceutical companies, Federal regulatory institutions and the American Medical Association, that deploy an intangible but forceful influence on decision-making. Resistance to change in pharma emanates from industry incumbents whose jobs rely on sustaining the existing business model and political power. As Upton Sinclair said, “Never expect someone to understand change when their livelihood depends on not understanding it.”

As the above example shows, the advancement of pharmaceutical innovation efforts are most often prevented by established world views, opinions, customs, attitudes, societal values and complex psychological and emotional issues ingrained in the network of relationships that define individuals singly or collectively. In certain situations, innovation challenges are rejected directly because they are seen as threats to the means of support and character of many stakeholders, such as pharmaceutical companies, Federal regulatory institutions and the American Medical Association, that deploy an intangible but forceful influence on decision-making. Resistance to change in pharma emanates from industry incumbents whose jobs rely on sustaining the existing business model and political power. As Upton Sinclair said, “Never expect someone to understand change when their livelihood depends on not understanding it.” In the future, the drug lifecycle needs to incorporate many facets of patient centricity, including the use of new technologies such as gene- and proteomics, gene therapy, nanotechnology, and Big Data driven predictive analytics. Precision medicine will identify exact patient needs and tailor molecular profiles to create the most beneficial treatment plans for patients on an individual level. New social media tools will allow patients to share information and participate in collaborative discussions with regulators and pharma.

In the future, the drug lifecycle needs to incorporate many facets of patient centricity, including the use of new technologies such as gene- and proteomics, gene therapy, nanotechnology, and Big Data driven predictive analytics. Precision medicine will identify exact patient needs and tailor molecular profiles to create the most beneficial treatment plans for patients on an individual level. New social media tools will allow patients to share information and participate in collaborative discussions with regulators and pharma. Pharmaceutical marketing is changing. With increased industry spend, new marketing channels, a more informed consumer, and a shifting healthcare landscape, it is clear that marketers need to be smarter than ever with their investment decisions. It is also clear that DTC marketing is no longer just about pumping money into national TV ad buys (though they continue to receive substantial investment). It’s now also about targeted messaging. It’s about digital. It’s about patient engagement. In this environment, it is more complex than ever to understand how to get the right message in front of the right consumer at the right time. Marketers will need to innovate.

Pharmaceutical marketing is changing. With increased industry spend, new marketing channels, a more informed consumer, and a shifting healthcare landscape, it is clear that marketers need to be smarter than ever with their investment decisions. It is also clear that DTC marketing is no longer just about pumping money into national TV ad buys (though they continue to receive substantial investment). It’s now also about targeted messaging. It’s about digital. It’s about patient engagement. In this environment, it is more complex than ever to understand how to get the right message in front of the right consumer at the right time. Marketers will need to innovate. There is room for a variety of insight techniques to understand the patient journey. But one of the most powerful, yet under-used, is ethnography. Contrary to the way some people think about it, ethnography is not just interviewing patients at home (or doctors in their offices). Ethnography is a way of observing people and understanding them using a holistic perspective.

There is room for a variety of insight techniques to understand the patient journey. But one of the most powerful, yet under-used, is ethnography. Contrary to the way some people think about it, ethnography is not just interviewing patients at home (or doctors in their offices). Ethnography is a way of observing people and understanding them using a holistic perspective. As we look back over the past year for lessons learned that we will take into the New Year, there are many we could choose: from celebrities on social media to controversial pricing. But based on our work with thousands of patients, helping to connect them with biopharma companies large and small, one of the top areas of concern right now is protecting their personal information.

As we look back over the past year for lessons learned that we will take into the New Year, there are many we could choose: from celebrities on social media to controversial pricing. But based on our work with thousands of patients, helping to connect them with biopharma companies large and small, one of the top areas of concern right now is protecting their personal information.